Roth Ira Excess Contribution

You ll need to reduce next year s contributions by the amount of the excess.

Roth ira excess contribution. 5 500 6 500 if you re age 50 or older or. Each year retirement savers must follow a contribution limit when they put money in their ira. To understand your options for removing an excess contribution let s review the contribution rules. Your excess contribution was 1 200.

The annual limit for both types of iras traditional and roth iras is a combined 5 500. The excess roth contribution would be an excess contribution even if it was made to a traditional ira instead e g because you contributed 3 000 at each of two different brokerage firms thereby exceeding the 5 500 limit or because your contribution was in excess of your compensation for the year. For example if your limit is 6 000 and you exceed it by 1 500 in the current year you can offset the excess by limiting your contributions to 4 500 the following year. If you don t correct the excess contribution for 2017.

Your taxable compensation for the year if your compensation was less than this dollar limit. Apply the excess to next year s contribution. How to fix an excess ira contribution withdraw the excess contribution and earnings. Let s say sarah is 45 years old and she sees that the 6 000 annual limit applies to her because she s not yet 50.

Withdraw the excess next year. You can make an additional catch up contribution of 1 000 a year for a total of 7 000 if you re age 50 or older. For 2015 2016 2017 and 2018 your total contributions to all of your traditional and roth iras cannot be more than. If you don t do one of the other options first.

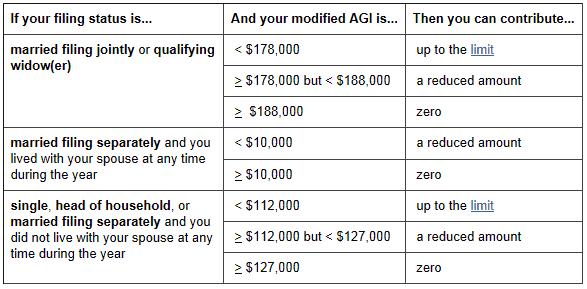

Most people can contribute up to 6 000 to a roth ira account as of 2019. For example suppose you made a 5 500 contribution to a roth ira early in 2017 then got a larger bonus than you expected and found that due to the income limitation your permitted contribution was only 4 300. Reporting excess contribution to the roth ira without having received a 1099 r for the distribution of the entire account to constitute a return of contribution presumably this contribution was your only contribution to the roth ira and was made to establish the account. Be aware you ll have to pay a 6 penalty each year until the excess is absorbed or corrected.