Roth Ira Excess Contribution Withdrawal

Remove the excess once discovered even after october 15.

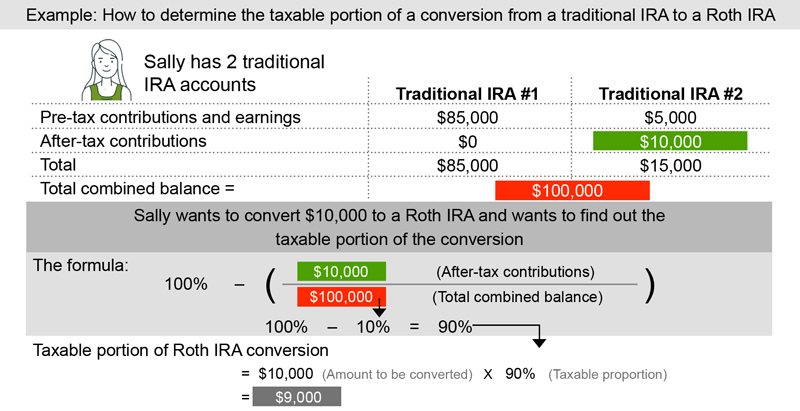

Roth ira excess contribution withdrawal. The withdrawal and re contribution is combined into one action. Roth ira withdrawal rules differ depending on whether you take out your contributions or your investment earnings. He can simultaneously withdraw 1 000 from his contributions for tax year 2018 and contribute the same 1 000 for tax year 2019. You ll need to reduce next year s contributions by the amount of the excess.

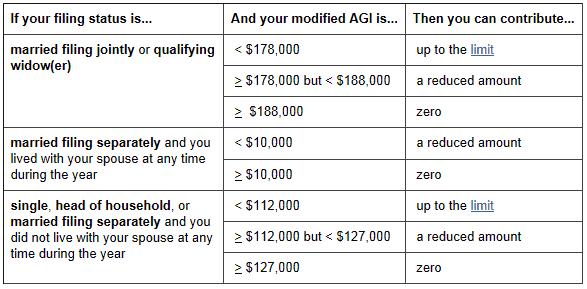

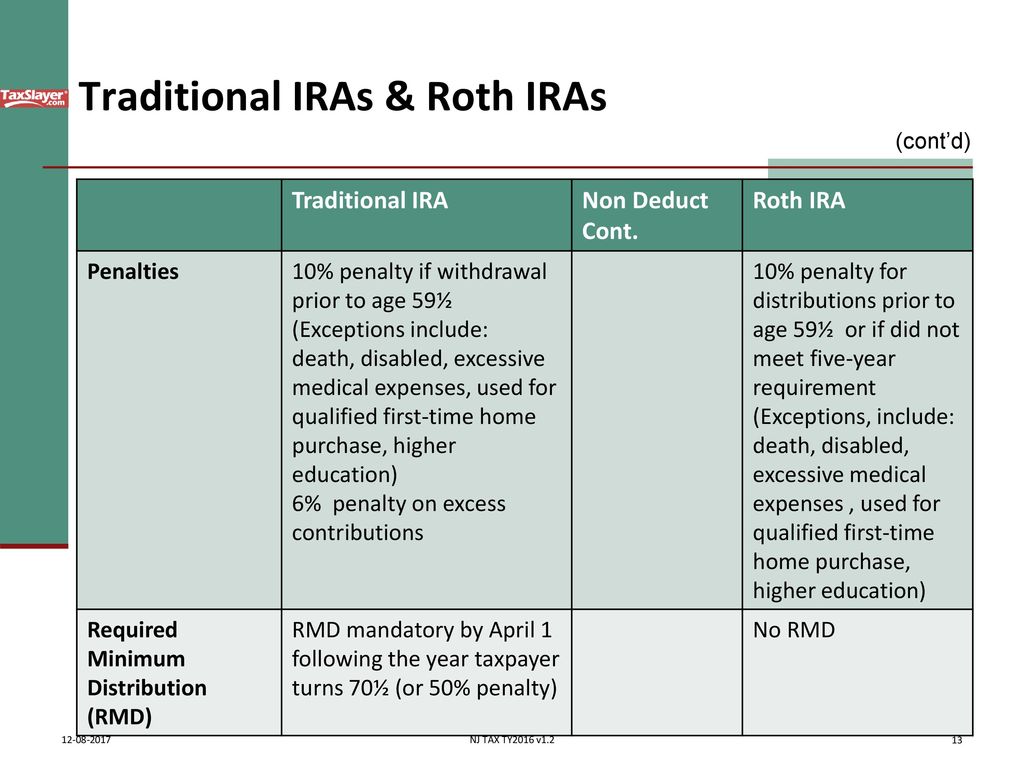

Contributions are the money you deposit into an ira while earnings are your. As mentioned above roth iras use the same contribution limit as traditional iras. How to withdraw excess roth ira contributions. Roth ira information tax on excess contributions.

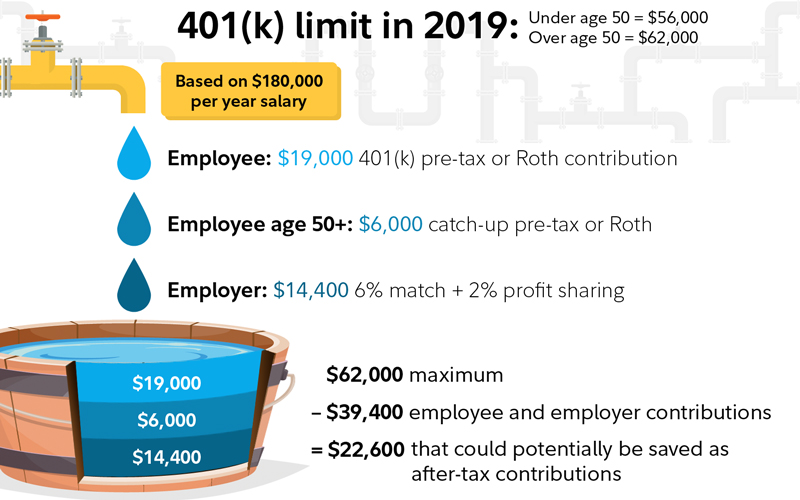

Let s say robert needs to withdraw 1 000 of his roth ira contributions because he s over the limit based on his income. For example suppose you made a 5 500 contribution to a roth ira early in 2017 then got a larger bonus than you expected and found that due to the income limitation your permitted contribution was only 4 300. Amounts contributed for the tax year to your roth iras other than amounts properly and timely rolled over from a roth ira or properly converted from a traditional ira or rolled over from a qualified retirement plan as described later that are more than your contribution limit for the year. For example if your limit is 6 000 and you exceed it by 1 500 in the current year you can offset the excess by limiting your contributions to 4 500 the following year.

If you ve contributed over the threshold you ll need to follow one of the methods to remove the excess. This is a 6 tax you re required to pay each year the excess contribution remains uncorrected.