Roth Ira Excess Contribution Tax Form

If you ve contributed over the threshold you ll need to follow one of the methods to remove the excess.

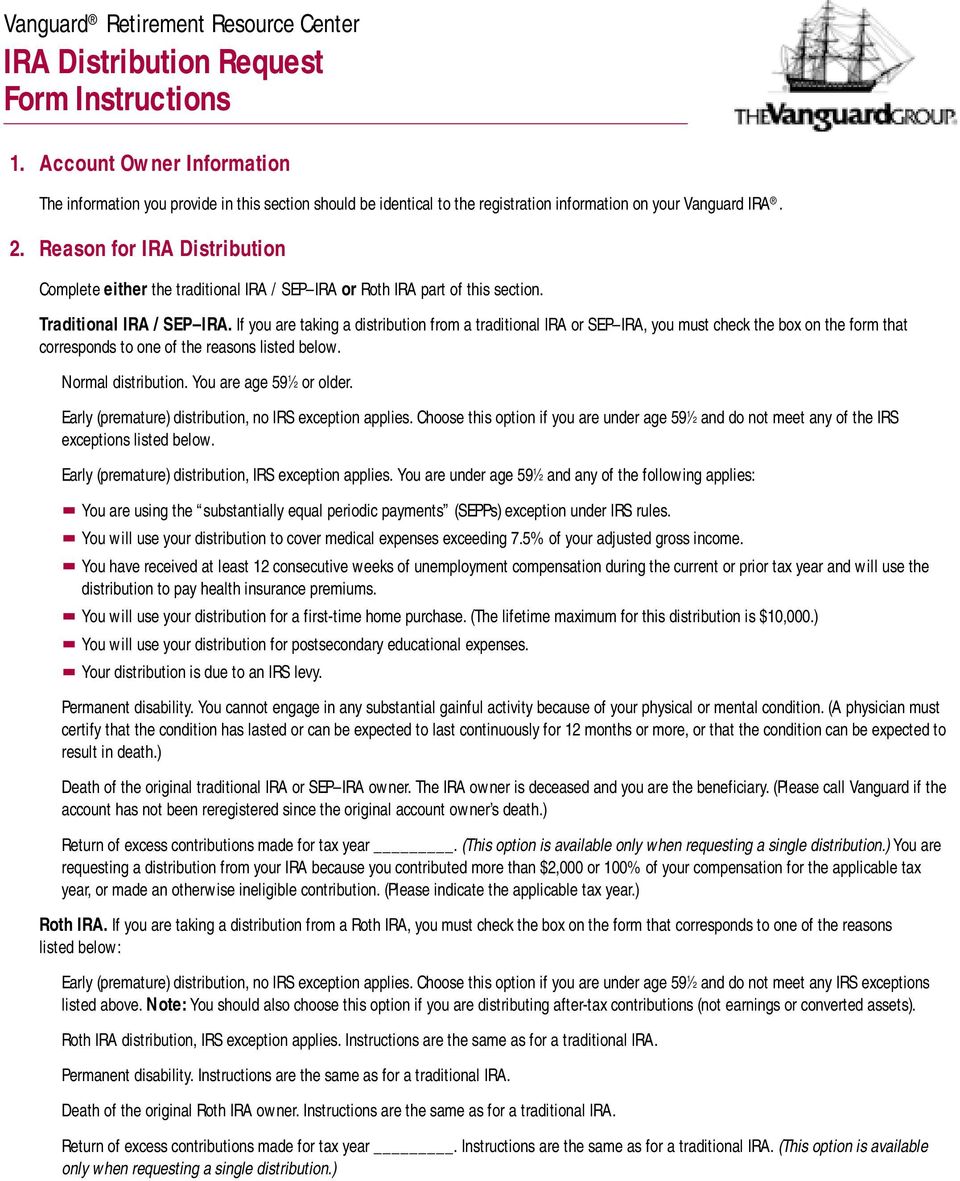

Roth ira excess contribution tax form. For the distribution of the entire account to constitute a return of contribution presumably this contribution was your only contribution to the roth ira and was made to establish the account. In the ira contribution area you would simply back out the contribution altogether so the excess penalty goes away. You received a distribution from a roth ira and either the amount on line 25c of form 8606 nondeductible iras is more than zero or the distribution includes a recapture amount subject to the 10 additional tax or it s a qualified first time homebuyer distribution see distributions from roth iras later. Your ira trustee or issuer not you is required to file this form with the irs by may 31.

For that reason form 5329 is considered a separate tax return. You can enter the 2019 form 1099 r as if you have already received it even though you will not be receiving the form from fidelity until early 2020. The withdrawal and re contribution is combined into one action. As mentioned above roth iras use the same contribution limit as traditional iras.

Be aware you ll have to pay a 6 penalty each year until the excess is absorbed or corrected. If your total ira contributions both traditional and roth combined are greater than your allowed amount for the year and you haven t withdrawn the excess contributions you ll owe a 6 penalty tax on the excess contribution and you must complete form 5329. Note that the 5 500 6 500 is a combined limit for both iras. If you contributed to a roth and traditional ira in the same tax year and your total contribution went over the allowable ira amount irs regulations require you to remove the excess from the roth ira first.

How to withdraw excess roth ira contributions. Unlike most other tax forms form 5329 has its own signature line like the form 1040. Excess roth ira contributions withdrawn. Let s say robert needs to withdraw 1 000 of his roth ira contributions because he s over the limit based on his income.

If the excess contribution relates to the current tax year 2016 you don t show that you removed the contribution per se. Ira contributions information reports your ira contributions to the irs. Ira or roth ira excess contributions. He can simultaneously withdraw 1 000 from his contributions for tax year 2018 and contribute the same 1 000 for tax year 2019.