Roth Ira Excess Contribution Removal

Let s say you are age 45 and you contribute 8 500 across your ira accounts.

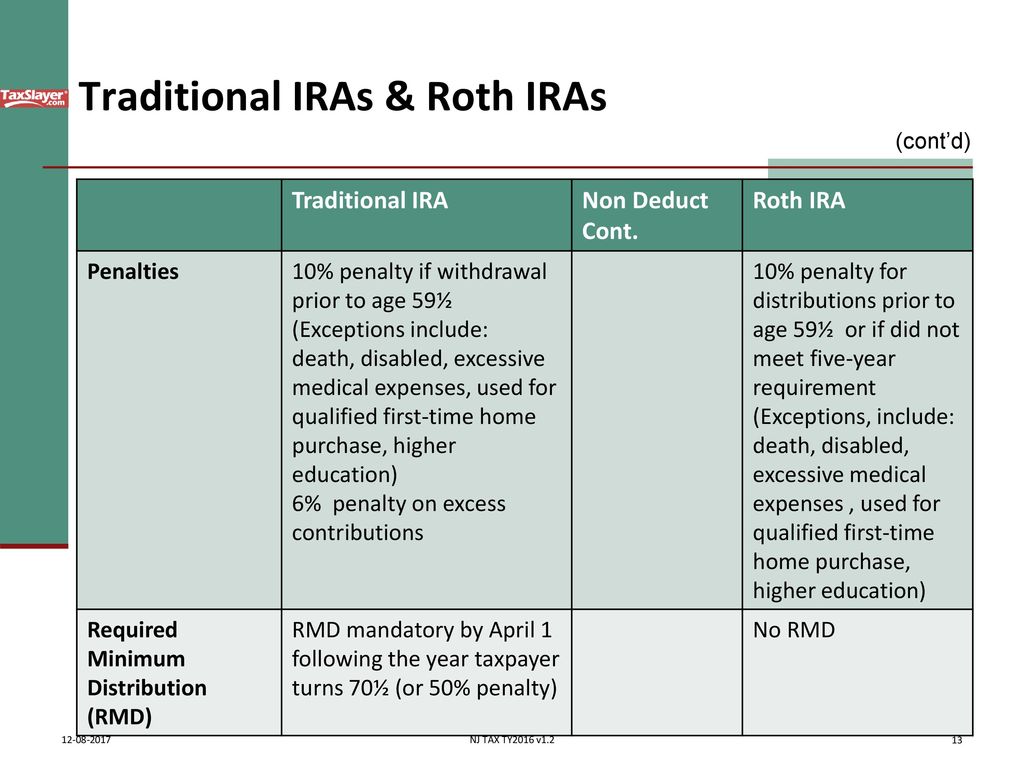

Roth ira excess contribution removal. For example if you contribute 1 500 too much you ll be assessed 90 per year until you take it out of the roth ira. He can simultaneously withdraw 1 000 from his contributions for tax year 2018 and contribute the same 1 000 for tax year 2019. You can avoid the 6 excise penalty tax. The excess roth contribution would be an excess contribution even if it was made to a traditional ira instead e g because you contributed 3 000 at each of two different brokerage firms thereby exceeding the 5 500 limit or because your contribution was in excess of your compensation for the year.

If you remove the contribution. Remove the excess once discovered even after october 15. Let s say robert needs to withdraw 1 000 of his roth ira contributions because he s over the limit based on his income. The penalty for making excess contributions is 6 percent of the extra money per year until you remove it from the ira.

You ll need to reduce next year s contributions by the amount of the excess. Roth ira excess contribution removal by tax file deadline but in a different year how to report gains without 1099r. Before your taxes are due and before filing your return. That means you have an excess ira contribution of 3 000.

The withdrawal and re contribution is combined into one action. Include the earnings in income for the year in which you made the contributions not the year in which you withdraw them.